2026 Medicare Advantage: Maximize Your Health Benefits

To maximize 2026 Medicare Advantage benefits, strategically evaluate plan options, utilize extensive supplemental offerings, commit to preventive care, understand network restrictions, and actively review annual changes for optimal health coverage and financial savings.

For many Americans, understanding their healthcare options is paramount, and when it comes to senior health, 2026 Medicare Advantage Benefits stand out as a crucial area of focus. This comprehensive guide is designed to help you navigate the complexities of Medicare Advantage plans for 2026, ensuring you make informed decisions to maximize your health benefits and secure your well-being.

Understanding 2026 Medicare Advantage: The Foundation

Medicare Advantage, also known as Medicare Part C, offers an alternative way to receive your Medicare benefits. Instead of directly from the government, your benefits are provided by private insurance companies approved by Medicare. These plans must cover all the services that Original Medicare (Parts A and B) covers, but they often include additional benefits not covered by Original Medicare.

As we approach 2026, it’s essential to recognize that these plans are continually evolving. Regulatory changes, advancements in healthcare technology, and shifting demographic needs all contribute to how Medicare Advantage plans are structured and what they offer. Staying informed about these foundational aspects is the first step toward making the most of your coverage.

What’s new for 2026?

The landscape of Medicare Advantage is dynamic, with annual updates that can significantly impact beneficiaries. For 2026, expect continued emphasis on personalized care, value-based models, and expanded access to telehealth services. Understanding these broader trends can help you anticipate specific plan changes.

- Increased focus on chronic care management programs.

- Potential for broader integration of social determinants of health benefits.

- Enhanced transparency requirements for plan comparisons.

In essence, becoming familiar with the core principles of Medicare Advantage and keeping an eye on the emerging trends for 2026 will empower you to select a plan that truly aligns with your health and financial goals. This foundational knowledge is critical for effective benefit maximization.

Strategic Move 1: Comprehensive Plan Evaluation and Selection

Choosing the right Medicare Advantage plan is perhaps the most critical decision you will make regarding your health coverage. It’s not just about picking a plan; it’s about finding the perfect fit for your individual health needs, financial situation, and lifestyle. A hasty decision can lead to unexpected costs or limitations in accessing care.

For 2026, the market will likely offer an even wider array of choices, making thorough evaluation more important than ever. This involves delving into the specifics of each plan, beyond just the premium, to understand the full scope of benefits and potential out-of-pocket expenses.

Key factors in plan comparison

When comparing plans, look beyond the monthly premium. A lower premium might come with higher deductibles, copayments, or coinsurance. Conversely, a higher premium could offer more comprehensive coverage and lower out-of-pocket maximums. It’s a balance that needs careful consideration.

- Network restrictions: Understand if the plan uses an HMO (Health Maintenance Organization) or PPO (Preferred Provider Organization) structure and how that impacts your choice of doctors and hospitals.

- Prescription drug coverage (Part D): Most Medicare Advantage plans include drug coverage. Compare formularies to ensure your medications are covered and at an affordable cost.

- Out-of-pocket maximums: This is the most you’ll have to pay for covered medical services in a year. A lower maximum offers greater financial protection.

Furthermore, consider your health status and anticipated medical needs for the coming year. If you have chronic conditions or foresee significant medical expenses, a plan with a lower out-of-pocket maximum and robust coverage for specialists might be more beneficial. Taking the time to meticulously evaluate these factors will help you select a 2026 Medicare Advantage plan that truly maximizes your health benefits.

Strategic Move 2: Leveraging Supplemental Benefits and Wellness Programs

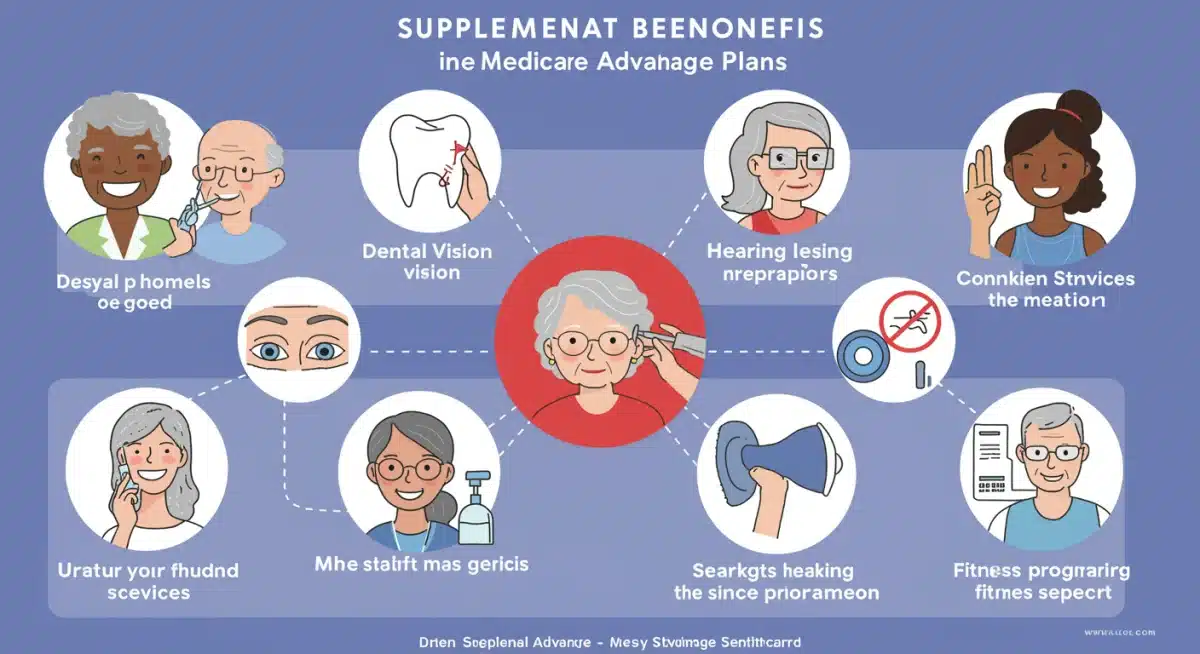

One of the most attractive aspects of Medicare Advantage plans is the inclusion of supplemental benefits that go beyond what Original Medicare offers. These benefits can significantly enhance your overall health and well-being, often at little to no extra cost. For 2026, plans are expected to continue expanding these offerings, making them even more valuable.

Many beneficiaries overlook these additional perks, focusing solely on medical and prescription drug coverage. However, fully utilizing these supplemental benefits can lead to considerable savings and improved quality of life. It’s about getting more value from your chosen plan.

Common and emerging supplemental offerings

While dental, vision, and hearing coverage have become standard in many plans, 2026 could see an increased variety of benefits aimed at holistic health. These might include expanded fitness programs, healthy food allowances, transportation to medical appointments, and even in-home support services.

- Dental, Vision, and Hearing: Crucial for maintaining overall health, these benefits can cover routine exams, cleanings, glasses, contact lenses, and hearing aids.

- Fitness Programs: Many plans offer memberships to gyms or fitness centers, encouraging an active lifestyle.

- Over-the-Counter (OTC) Allowances: A quarterly or annual allowance for common OTC health products can reduce out-of-pocket expenses for everyday necessities.

- Meal Delivery Services: Especially beneficial after a hospital stay or for those managing chronic conditions.

Actively investigating and utilizing these supplemental benefits is a smart way to maximize your 2026 Medicare Advantage Benefits. Don’t leave money or valuable services on the table. Review your plan’s Evidence of Coverage document thoroughly to identify all the additional perks available to you and integrate them into your health management routine.

Strategic Move 3: Prioritizing Preventive Care and Wellness

Preventive care is the cornerstone of good health and a key component of maximizing your Medicare Advantage benefits. These plans are designed to encourage proactive health management, offering numerous services at little to no cost to prevent illnesses and detect health issues early. For 2026, the emphasis on preventive measures will likely remain strong, aligning with broader healthcare goals.

Ignoring preventive services can lead to more serious health problems down the line, resulting in higher treatment costs and a decreased quality of life. By taking advantage of these benefits, you can maintain better health and reduce your overall healthcare expenditures.

Maximizing your preventive benefits

Many preventive screenings and services are covered 100% by Medicare Advantage plans, provided you use in-network providers. This includes annual wellness visits, various cancer screenings, vaccinations, and screenings for chronic conditions like diabetes and high blood pressure.

- Annual Wellness Visits: These visits are crucial for developing or updating your personalized prevention plan.

- Cancer Screenings: Regular mammograms, colonoscopies, and prostate cancer screenings can detect issues early when they are most treatable.

- Vaccinations: Stay up-to-date with flu shots, pneumonia vaccines, and other recommended immunizations.

- Chronic Disease Management Programs: If you have a chronic condition, many plans offer tailored programs to help you manage it effectively.

Engaging actively in preventive care not only supports your personal health but also demonstrates a smart approach to utilizing your 2026 Medicare Advantage Benefits. Make it a priority to schedule your annual check-ups and screenings, and discuss any health concerns with your doctor. This proactive stance is invaluable for long-term health and financial stability.

Strategic Move 4: Understanding Network Restrictions and Referrals

While Medicare Advantage plans offer comprehensive benefits, it’s crucial to understand how their provider networks and referral systems operate. Unlike Original Medicare, which allows you to see any doctor or hospital that accepts Medicare, Medicare Advantage plans often have specific networks of providers. Failing to understand these restrictions can lead to unexpected out-of-pocket costs or difficulties accessing care.

For 2026, plans will continue to refine their networks, and while some offer more flexibility, others may be more restrictive. Knowing the difference and how it impacts your access to care is essential for maximizing your benefits and avoiding surprises.

Navigating HMO vs. PPO structures

The two most common types of Medicare Advantage plans are Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). Each has distinct rules regarding provider access and referrals.

- HMO Plans: Typically require you to choose a primary care physician (PCP) within the plan’s network who then coordinates all your care. You usually need a referral from your PCP to see specialists, and services received outside the network are generally not covered, except in emergencies.

- PPO Plans: Offer more flexibility. You don’t usually need a referral to see a specialist, and you can see out-of-network providers, though you’ll typically pay more for those services.

Before enrolling in a 2026 Medicare Advantage plan, verify that your preferred doctors, specialists, and hospitals are included in the plan’s network. If you travel frequently or prefer the option to see out-of-network providers, a PPO plan might be a better fit, despite potentially higher costs. Understanding these nuances is vital to ensure seamless access to the healthcare providers you trust, making your Medicare Advantage experience as beneficial as possible.

Strategic Move 5: Annual Review and Adaptation During Open Enrollment

The world of Medicare is not static; plans and personal needs change. This is why the annual Open Enrollment Period (typically October 15 to December 7) is a critical time to review your 2026 Medicare Advantage Benefits and make adjustments. What worked for you last year might not be the best fit for the upcoming year.

Ignoring this annual opportunity means you could be missing out on better benefits, lower costs, or more suitable coverage options that have emerged. Regular review ensures your plan continues to align with your evolving health status and financial goals.

Key considerations for annual review

During open enrollment, plans can change their premiums, deductibles, copayments, and even their provider networks and formularies. Your health needs might also have shifted, requiring different coverage.

- Check for changes in your current plan: Review the “Annual Notice of Change” (ANOC) document your plan sends you. This outlines all changes for the upcoming year.

- Evaluate your health needs: Have your prescriptions changed? Do you anticipate needing new specialists or procedures?

- Compare other plans: Use the Medicare Plan Finder tool on Medicare.gov to compare all available plans in your area, not just your current one. New plans or existing plans with improved benefits might be a better option.

- Seek professional advice: If you find the options overwhelming, consider consulting with a licensed insurance agent specializing in Medicare plans. They can provide personalized guidance.

By proactively engaging in the annual review process, you ensure that your 2026 Medicare Advantage Benefits remain optimized for your circumstances. This strategic move is perhaps the most important for long-term satisfaction and maximizing the value of your healthcare coverage year after year.

Future Trends and Long-Term Planning for 2026 Medicare Advantage

Looking ahead to 2026 and beyond, the Medicare Advantage landscape is poised for continued innovation and adaptation. Understanding these potential future trends allows for more effective long-term planning, ensuring your healthcare coverage remains robust and responsive to your needs. The focus will likely intensify on personalized medicine, digital health solutions, and integrated care models.

Staying informed about these broader shifts is not just an academic exercise; it’s a practical step toward anticipating changes that could impact your benefits and choices in the coming years. Proactive planning can help you adapt seamlessly to new developments.

Anticipated developments in Medicare Advantage

Several key areas are expected to see significant growth and refinement within Medicare Advantage plans. These trends reflect a broader move towards more patient-centric and technology-driven healthcare.

- Telehealth Expansion: Expect even greater integration and coverage of telehealth services, making healthcare more accessible, especially for those in rural areas or with mobility challenges.

- Personalized Benefits: Plans may offer more tailored benefits based on individual health profiles and social needs, moving beyond a one-size-fits-all approach.

- Integration of AI and Data Analytics: Insurers will likely leverage AI to identify at-risk beneficiaries and offer more targeted interventions, improving health outcomes.

- Value-Based Care Models: The shift towards rewarding providers for patient outcomes rather than just services rendered will continue, potentially leading to higher quality care.

For individuals approaching or already enrolled in Medicare Advantage, keeping an eye on these future trends is crucial. It empowers you to ask the right questions during open enrollment, anticipate new benefit offerings, and make choices that align with the evolving healthcare environment. Long-term planning, informed by these insights, is key to continuously maximizing your 2026 Medicare Advantage Benefits and beyond.

| Key Strategy | Brief Description |

|---|---|

| Evaluate Plans Carefully | Compare networks, costs, and drug coverage to find the best fit for your health and budget. |

| Utilize Supplemental Benefits | Take advantage of dental, vision, fitness, and other additional perks to enhance well-being. |

| Prioritize Preventive Care | Engage in annual wellness visits and screenings to maintain health and prevent future issues. |

| Annual Review and Adapt | Actively review your plan during Open Enrollment to ensure it still meets your changing needs. |

Frequently asked questions about 2026 Medicare Advantage plans

Original Medicare is a federal program directly administered by the government, while Medicare Advantage (Part C) plans are offered by private insurance companies approved by Medicare. Advantage plans often include additional benefits like dental, vision, and prescription drug coverage, which Original Medicare typically does not.

You can check a plan’s provider directory on the insurance company’s website or by contacting them directly. The Medicare Plan Finder tool on Medicare.gov also allows you to search for plans by provider. It’s crucial to confirm your preferred providers are in-network before enrolling.

Most 2026 Medicare Advantage plans, known as MA-PDs, include prescription drug coverage (Medicare Part D). However, it’s essential to review the plan’s formulary (list of covered drugs) to ensure your specific medications are included and understand their cost-sharing structure.

The best time to review and potentially change your Medicare Advantage plan is during the annual Open Enrollment Period, which runs from October 15th to December 7th each year. This allows any changes to take effect on January 1st of the following year, including for 2026.

If you move outside your plan’s service area, you’ll typically qualify for a Special Enrollment Period to switch to a new Medicare Advantage plan available in your new location. It’s vital to notify your plan and Medicare of your move promptly to avoid any gaps in coverage.

Conclusion

Unlocking 2026 Medicare Advantage: How to Maximize Your Health Benefits with 5 Strategic Moves is not merely about enrollment; it’s about active engagement and informed decision-making. By thoroughly evaluating plans, leveraging the often-underutilized supplemental benefits, prioritizing preventive care, understanding network dynamics, and consistently reviewing your options during open enrollment, you can ensure your healthcare coverage truly serves your needs. The future of Medicare Advantage promises further innovation, making it even more crucial to stay informed and proactive. Taking these steps empowers you to navigate the complexities of healthcare with confidence, securing your health and financial well-being for years to come.