degree global economic forecast: what to expect

To prepare for economic changes, understand key indicators, diversify investments, build an emergency fund, and continuously educate yourself about personal finance to effectively navigate uncertainties.

Degree global economic forecast explores the future landscape of economies worldwide. Have you ever wondered how shifts in economic conditions affect your daily life? Let’s dive in and explore what experts anticipate.

Understanding global economic forecasts

Understanding global economic forecasts is essential for grasping the future of economies worldwide. These forecasts help businesses, governments, and individuals anticipate changes and prepare for what lies ahead.

What Are Economic Forecasts?

Economic forecasts are projections about future economic conditions. They use various data to predict trends in areas like growth, inflation, unemployment, and trade. By analyzing historical data along with current events, experts can make informed predictions.

Why Are They Important?

Forecasts provide insight that can influence decision-making. For example, businesses might adjust their strategies based on expected consumer spending. Similarly, governments may alter fiscal or monetary policies based on these predictions.

- Helps businesses plan for growth or contraction.

- Guides policy makers in economic decisions.

- Affects investor confidence and stock market behavior.

Moreover, international events such as conflicts or pandemics can drastically shift forecasts. Thus, staying updated is vital.

In essence, understanding global economic forecasts allows individuals and businesses to navigate uncertainties effectively. By focusing on key indicators, they can position themselves strategically for the future.

Key factors influencing the global economy

Many key factors influencing the global economy can shape the economic landscape. From consumer behavior to government policies, these elements play a crucial role in determining economic outcomes.

Consumer Behavior

Consumer spending is one of the primary drivers of economic activity. When people feel confident in their financial situation, they tend to spend more. This increase in spending boosts demand for goods and services, leading to economic growth.

Government Policies

Government decisions also have a profound impact. Fiscal policies, such as tax cuts or increased spending, can stimulate economic activity. Conversely, austerity measures might slow growth. Additionally, monetary policies set by central banks influence interest rates and money supply.

- Changes in interest rates affect borrowing and spending.

- Tax policies can encourage or discourage investment.

- Regulations can impact business expansion and operations.

Moreover, geopolitical events can shift economic trends rapidly. Natural disasters, wars, and economic sanctions can lead to fluctuations in markets and trade. Understanding these dynamics is vital for predicting future economic conditions.

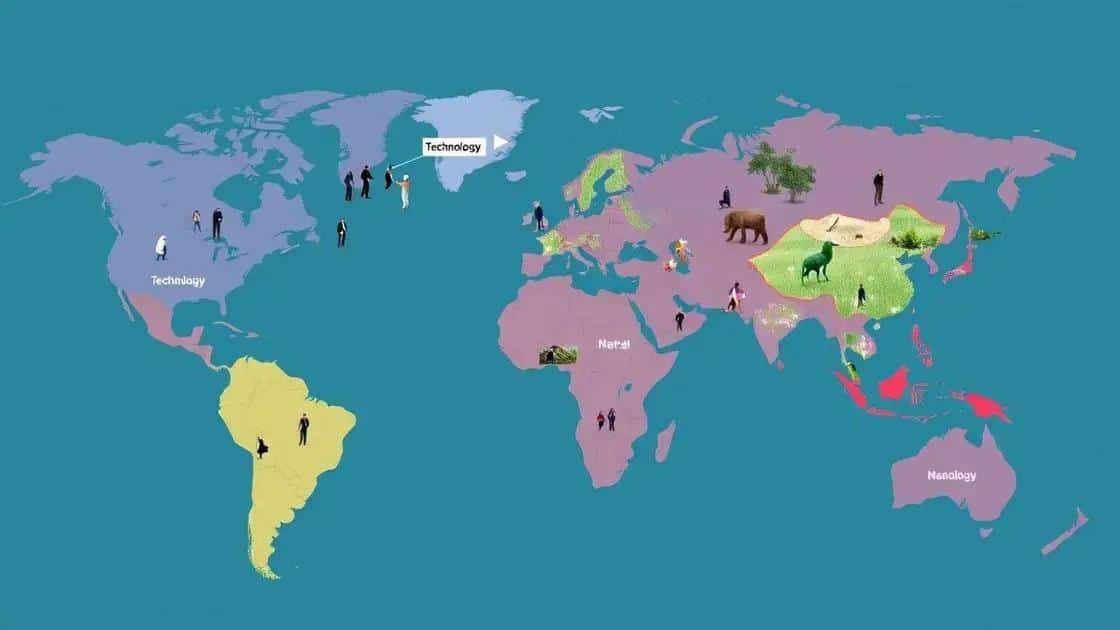

Finally, technology plays a vital role in shaping economies. Innovations can drive productivity, create new markets, and change consumer preferences. The rise of e-commerce is a prime example of how technology alters the economic landscape.

Regional variations and their impacts

Regional variations in the economy can significantly affect global markets. Different areas experience unique economic conditions, influenced by local resources, cultures, and policies. Understanding these variations is crucial for grasping the overall economic landscape.

Diversified Economies

Some regions have diversified economies that thrive on multiple industries. For example, a region with strong technology and agriculture sectors may be more resilient to economic downturns. Areas rich in natural resources can also benefit from global demand, creating economic stability.

Impact of Local Policies

Local government policies can shape economic activities. Tax incentives for businesses spurring growth can attract investment. On the other hand, strict regulations may hinder business expansion. Thus, the economic environment varies widely across regions.

- Investment incentives can boost job creation.

- Trade barriers can limit market access.

- Infrastructure development is crucial for economic growth.

Additionally, cultural factors play a role. Regions with a strong entrepreneurial spirit often see higher levels of innovation and business startups. In contrast, areas lacking this mindset may struggle to compete.

In conclusion, recognizing regional variations helps understand the dynamics of the global economy. By paying attention to these differences, investors and policymakers can make better decisions.

Long-term predictions and implications

Long-term predictions of the economy are essential in guiding decisions for businesses and policymakers. These forecasts help people understand potential trends and prepare for what the future may hold.

Factors Influencing Long-Term Predictions

Several factors can affect long-term economic predictions. A significant driver is technological advancement. Innovations, such as artificial intelligence and renewable energy, can create new industries and transform existing ones. Understanding these trends is crucial for making sound economic decisions.

Demographic Changes

The aging population in many countries will also have implications for the economy. As the workforce shrinks, there may be fewer workers to support economic growth. This shift could lead to increased demand for healthcare and retirement services.

- Changes in population growth rates impact labor markets.

- Urbanization trends can influence regional economies.

- Shifts in consumer demographics affect spending patterns.

Another critical area to consider is globalization. As markets become more interconnected, events in one region can greatly affect others. Trade agreements and tariffs will continue to shape economic relations between countries.

Environmental considerations are increasingly important. Climate change can disrupt supply chains and cause economic instability. Understanding these risks is vital for future planning. Therefore, recognizing the long-term predictions along with their implications can help everyone make better strategic choices.

How to prepare for economic changes

Preparing for economic changes is essential for individuals and businesses alike. With the fluctuations in the global economy, being proactive can make a significant difference in how one navigates challenges.

Understanding Economic Indicators

First, it’s crucial to understand the key economic indicators that signal changes. These include unemployment rates, gross domestic product (GDP), and consumer confidence indexes. Monitoring these indicators helps anticipate economic shifts.

Diversifying Investments

Diversification is another effective strategy. By spreading investments across different asset classes like stocks, bonds, and real estate, one can reduce risk. A well-diversified portfolio can better withstand economic downturns.

- Consider investing in both domestic and international markets.

- Look into alternative investments like commodities or cryptocurrencies.

- Regularly review and adjust your portfolio according to market trends.

Additionally, building an emergency fund is vital. Having savings set aside can provide a safety net during uncertain times. This fund should ideally cover three to six months of living expenses.

Educating oneself about personal finance also plays a critical role. Understanding budgeting, debt management, and investment basics empowers individuals to make informed decisions. Knowledge is key during periods of economic volatility.

FAQ – Preparing for Economic Changes

What are key economic indicators to watch?

Key indicators include GDP, unemployment rates, and consumer confidence, which signal changes in the economy.

Why is diversifying investments important?

Diversifying investments reduces risk by spreading your money across different asset classes.

How much should I save for an emergency fund?

An emergency fund should ideally cover 3 to 6 months of living expenses to provide financial security during uncertain times.

How can I educate myself about personal finance?

You can learn about budgeting, debt management, and investments through books, online courses, and financial workshops.